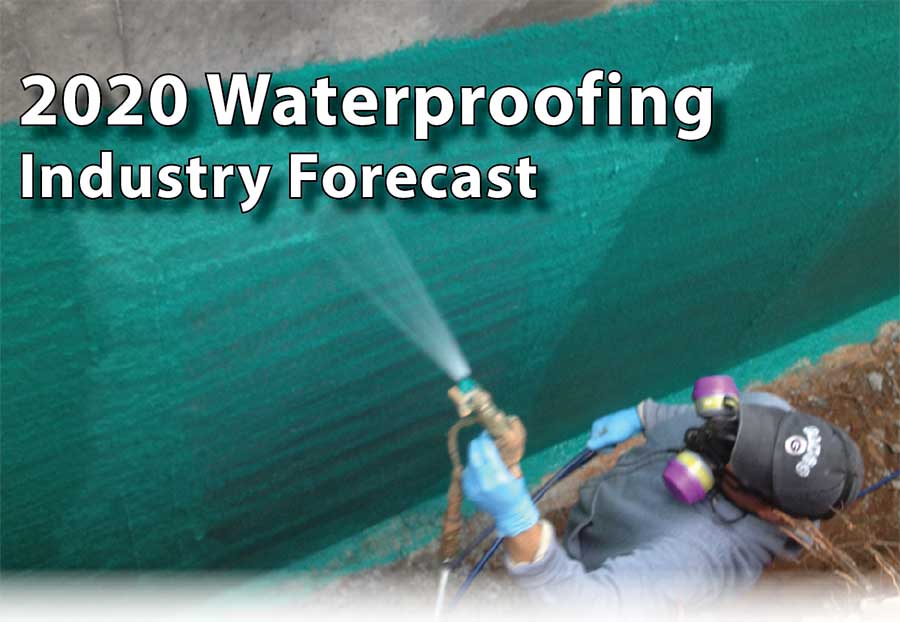

As we move into 2020, the waterproofing industry appears poised for another solid year of growth.

New construction may be slowing down in both the residential and commercial sectors, but the growing use of new technologies—such as carbon fiber, air barriers, and roofing materials—will allow innovative companies to continue to grow.

There are additional challenges and opportunities as well for the waterproofing and structural repair sectors. Still, well managed companies should be optimistic. Here’s a more detailed outlook.

Residential Outlook

New home construction makes up a significant share of most waterproofing contractors’ portfolios. With the rise of spray-applied air barriers in the residential sector, there is more opportunity than ever before. The economy has settled into a period of solid, steady growth, and new home construction in 2020 is predicted to continue to increase. The National Association of Realtors predicts that single-family home starts will rise 6% in 2020, driven by low mortgage rates—below 4.0 percent—and a growing number of Millenials finally transitioning to home ownership. By the middle of 2020, more than 50% of homebuyers will be Millennials.

New technologies and techniques, such as encapsulated crawlspaces, should present ample growth opportunities in the residential sector.

Realtor.com, which manages one of the largest databases of housing statistics available, is predicting that in 2020, the U.S. could be facing the worst housing shortage in its history. To be more precise, they indicate a shortage of affordable housing.

Zoning regulations which prohibit high-density housing, more stringent building codes, and municipal impact fees are all driving up the cost of new construction, pushing it out of reach for many.

For contractors who specialize in remedial waterproofing, structural repair, basement finishing, and renovation, 2020 should see continued growth. The U.S. economy is at functionally full employment, wages are growing, interest rates are low, and homeowners and building managers finally have the means to tackle years of deferred maintenance.

Customers are showing strong preference for contractors who understand the latest technology and trends. Encapsulated crawlspaces, internet-connected sump pumps, carbon fiber repair, and modern egress windows are a few examples of rapidly growing opportunities in the residential sector.

Commercial Sector

Demand for commercial waterproofing should remain strong. The waterproofing membrane market is growing faster than the economy at large, and is on track to top $9.5 billion by 2022.

Manufacturers of fluid-applied membranes and sheet good are both reporting solid sales growth, both above and below grade.

In late October, Dodge Data and Analytics issued their forecast, predicting that U.S. commercial construction starts will decline by 4% compared to 2019 levels, due to labor constraints and turmoil in international trade.

Richard Branch, chief economist for Dodge Data & Analytics, says, “The recovery in construction that began in 2010 is coming to an end. Easing economic growth, driven by mounting trade tensions and a lack of skilled labor will lead to a broad based, but orderly pullback in construction starts in 2020. After increasing 1% in 2019, they will fall 4% in 2020.”

Given the multi-year design/build timeline for most commercial projects, waterproofers may not see the impact of this pullback immediately. Branch continues, “Construction starts will decline but the level of activity will remain close to recent highs. By major construction sector, the dollar value of starts for residential buildings will be down 6%, while starts for both nonresidential buildings and nonbuilding construction will drop 3%.”

While private construction is set for a modest pullback, public construction is moving ahead at a brisk pace. Ed Sullivan, chief economist at the Portland Cement Association, explains, “Public construction continues to receive the benefit of the 2018 federal budget that allowed for $20 billion in spending on roads, bridges, water, and rail projects.”

Commercial roofing is being transformed by spray-applied coatings that dramatically extend roof life at minimal cost.

Commercial Roofing

The forecast for the commercial roofing sector is very similar to the one outlined above for commercial waterproofing in general. The wrinkle is that the commercial roofing industry is being transformed. Single ply mem-branes are extremely popular, and spray-applied coatings are revolutionizing the retrofit market by dramatically extending the life of the roof at minimal cost.

This forecast includes TPO, EPDM, and PVC sheet products in the single-ply category. Fluid-applied coatings include polyurethane, rubber polymer, and acrylic.

Roofing contractors and material suppliers who offer either or both of these technologies should see solid profits next year.

Economic Outlook

For the past five years, the construction industry has been booming. Economists calculate growth from the previous low point, so by this metric, the U.S. economy has been expanding since the middle of 2009. The U.S. is basically at full employment, where virtually everyone who wants to work has a job, with rising wages and employment stability. While this creates headaches when trying to find skilled labor, it’s also the driving force behind the current expansion.

“It will take some time before the economy takes a significant downturn,” agrees Sullivan. Still, he points out that the economy is now in the longest economic expansion in post-World War II history. “The pent-up demand that invigorated the initial stages of economic recovery are long past,” he warns. “As such, the economy is now more vulnerable to economic shocks.”

He continues, “While PCA does not believe that the data suggests a recession is near, it does point to a gradually weakening economy.”

Winter 2020 Back Issue

$4.95

Trade Show Preview

Waterproofing Industry Forecast

Sustainable Leak-Free Roofing

Rehabilitating Reeds Creek Fish Hatchery

AVAILABLE AS DIGITAL DOWNLOAD ONLY

Description

Description

Trade Show Preview

Here’s what to expect at the World of Concrete and International Roofing Expo, the waterproofing-related exhibitors, and how to maximize the opportunities these shows offer.

Waterproofing Industry Forecast

A slowing trend in new home construction, code changes, and increasing natural disasters all have a significant effect on the waterproofing industry. This story examines what may be in store for the next 12 months.

Sustainable Leak-Free Roofing

A wide range of roofing materials exist to provide durable, low-maintenance roofing while at the same time being friendly to the environment.

Rehabilitating Reeds Creek Fish Hatchery

By Robert Armstead

When water leakage undermined the concrete “raceways” used to raise trout, the state-run fish hatchery turned to polyurethane to fill the voids quickly and without causing issues for the fish.

Additional Info

Additional information

| Magazine Format | Digital Download Magazine, Print Mailed Magazine |

|---|