by Clark Ricks

Photo Courtesy S.Borisov/Shutterstock

When the Housing Bill didn’t immediately fix the foreclosure crisis, Wall Street banks were suddenly in a panic.

For several months now, news programs have been filled with talk of government bailouts, recession, and how to fix an ailing economy. Here’s a summary of what’s happening in Washington, and how it affects the owner of a small waterproofing company.

The Bush Administration, threatened with a global recession and pressured Treasury and Federal Reserve economists, ramrodded two major “bailout” bills through the U.S. Congress, aimed a jump-starting the sluggish economy.

The Root Cause

At its core, the problem was caused by overbuilding in the housing market. Deregulation during the Clinton years, followed by steep interest rate cuts in the months following the Sept. 11 terrorist attacks, created a huge boom in the housing market.

By 2004 and 2005, builders were constructing twice as many homes as the market could absorb.

During this time period, questionable lending practices allowed buyers to purchase a home with 0% down, and no proof of income. Interest-only loans and other sub-prime lending arrangements let people “buy” houses without the means to pay for them.

When the bubble burst, the huge inventory of new housing caused prices to fall. Prospective buyers held back, waiting for prices to hit bottom before buying.

In the meantime, the Fed had raised interest rates. Adjustable rate mortgages (ARMs) and other sub-prime loans were re-setting to a higher monthly payment that owners simply couldn’t afford. Finding that they owed more than the property was worth, many walked away. Others tried to refinance, but couldn’t, and the bank foreclosed.

The foreclosures flooding the market pushed prices even lower, and Congress felt forced to act.

The Housing Bill

The first bill, formally titled “The Housing and Economic Recovery Act of 2008” was signed into law in July. It is intended to revive a construction market that is suffering through the worst slowdown in at least 50 years.

Senate Banking Committee Chairman Chris Dodd (D-Conn.), a chief architect of the bill, calls it “the most important piece of housing legislation in a generation.” It is the government’s most aggressive intervention in the housing market since the Great Depression of the 1930s.

The most useful item in the package, according to experts, is the “First-Time Home Buyer Credit,” a temporary $7,500 tax credit intended to stimulate home buying, reduce excess supply in housing markets and shore up home prices.

The bill also includes tax credits for low-income housing.

Using taxpayer dollars, the government will also refinance up to $300 billion in troubled mortgages to keep pre-foreclosure homes off the market.

Lastly, the bill gives the FDMC and FNMA, popularly called Fannie Mae and Freddie Mac, several hundred billion dollars in loans in an effort to them afloat, and transfers control of the two lenders to the U.S. Treasury Department, away from Congressional oversight.

While the total cost of the bill is unknown, most financial analysts estimate it to be about $500 billion. One last note to small business owners: The 2008 Housing Bill requires all credit card transactions to be reported to the Internal Revenue Service, the U.S. tax collection agency.

Basically, it enables the IRS to quickly verify that you’re paying taxes on all your credit card receipts and other electronic transactions. If you’re not, you’ll probably face an audit.

The Finance Bailout Bill

When the Housing Bill didn’t immediately fix the foreclosure crisis, Wall Street banks were suddenly in a panic. Brokers had bundled the risky mortgages into packages, which were purchased by major investment banks. When foreclosures began to rise and home values stopped appreciating, these “investments” were suddenly worthless. Many of the biggest names on Wall Street were heavily involved with these deals and found themselves teetering on bankruptcy.

Credit markets began to freeze up. Small businesses, large construction projects, and anyone else who needed financing found it impossible to secure.

Henry Paulson, secretary of the treasury and a former Wall Street executive, begged the government to intervene. When the first attempt to rescue Wall Street failed to pass, Paulson, literally on bended knee, pled with Congressional leaders to try again. The second attempt passed and was signed into law less than an hour later.

The $700 billion bill is an attempt to keep credit markets functioning. The theory is that by injecting a huge amount of cash into the system, banks will feel confident enough to make loans. These loans will allow businesses to survive, even grow, and the stock market will grow as well.

So far, the results have been mixed. Credit is starting to become available, but the stock market is still in free-fall mode. In the three weeks since the bill passed on Oct. 1, the S&P 500 has fallen from 1,200 points to around 900. The Dow Jones has dropped about 25% in that time period as well.

Bottom Line

The lack of credit availability is still serious, and is shutting down commercial jobs. The glut of homes on the market is preventing a turnaround in the residential sector.

The two massive spending bills are well-intentioned, but haven’t shown any immediate effect. Analysts suspect construction may finally hit bottom in the third

quarter of 2009.

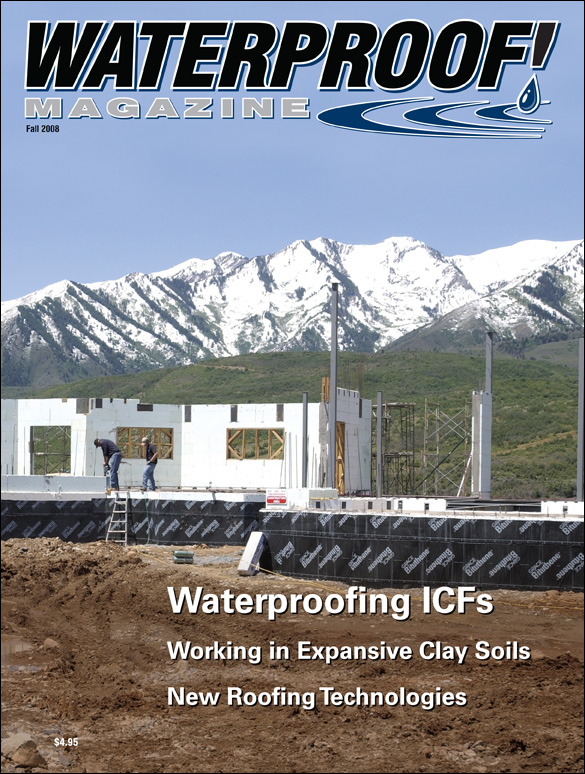

Fall 2008 Back Issue

$4.95

Waterproofing ICFs: Why it’s Important to get it Right

Waterproofing in Expansive Clay Soils

Traditional Roofing vs. New Alternatives

AVAILABLE AS A PDF DOWNLOAD ONLY

Description

Description

Waterproofing ICFs: Why it’s Important to get it Right

By David Polk

Insulating Concrete Forms are hollow foam blocks. Filled with reinforced concrete, they create a strong, and energy efficient foundation. They are also notoriously difficult to waterproof. Here’s how to do it right.

Waterproofing in Expansive Clay Soils

By Dan Calabrese

Expansive soils are strong enough to crack foundations if they get too wet or dry. Designers and builders must use specialized materials and techniques to ensure their foundations stay intact.

Traditional Roofing vs. New Alternatives

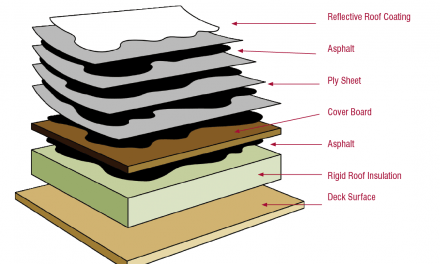

The roofing industry has changed substantially in the last decade or so. New materials have emerged, and old ones can look completely different. Here’s how they compare in price, performance, and durability.

Additional Info

Additional information

| Magazine Format | PDF Downloadable Magazine, Print Mailed Magazine |

|---|